SICPATRACE® Evo

The most advanced solution for mobilising revenue and ensuring fiscal compliance.

SICPATRACE® Evo is a comprehensive and flexible toolset designed to mobilise fiscal revenue and strengthen compliance, while ensuring easy adoption and seamless integration with the local manufacturing, importation and distribution environments.

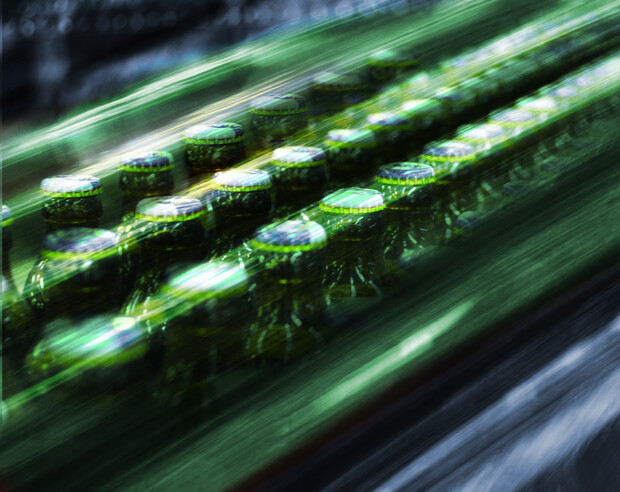

Currently deployed in more than 20 countries, SICPATRACE® Evo monitors supply chains by uniquely and securely marking, tracking, tracing and authenticating goods throughout their life cycle. This provides full visibility to authorities looking to reduce illicit trade practices such as under-declaration, tax evasion, smuggling, counterfeiting and distribution of unauthorised goods.

The solution is an efficient and secure digital tax stamp management system that supports government authorities in controlling the production, import, export, and distribution of excise products such as tobacco, spirits, wine, beer, and other consumer goods. It provides unique security and robust authentication through either label based marking or on-product direct marking, ensuring a solution for even the most challenging production environments.

Customisable features that enable authorities to monitor execution and compliance with regulations in real-time

The technology platform provides administration tools to support taxpayer management, licensing procedures, product master data management, taxation schemes, and procurement of tax stamps

Traceability and monitoring system that can be flexibly integrated into the local context of production, distribution, and consumption

Modular architecture allowing authorities to start with an initial set of product categories and capabilities before expanding them over time

A fully integrated modular solution

Our solution consists of a variety of modules:

Relying on a robust, secure and agile technology platform, SICPATRACE® Evo expedites deployments and eases integration with any legacy systems, ultimately building an ecosystem of trust.

CONSUMER VERIFICATION

- Connect and engage with citizens

- Help consumers identify illicit items

Detect hot spots of illicit goods in circulation

INSPECTION & ENFORCEMENT

- Conduct simple, fast and reliable field inspections

- Collect and analyse data for risk analysis and hot-spot detection

Generate court admissible evidence for efficient law enforcement

PRODUCT MARKING

- Mark each product item with a unique serialised code

- Multi-level security features mitigating risks of counterfeiting and code duplication

Anti-tampering features preventing the removal and the reuse of marks

TRACK & TRACE

- Real-time data collection (production control) using secure anti-tampering equipment

- Interoperable open architecture

- Compliant with industry standards and international regulations

GOVERNMENT ADMINISTRATION

- Efficient management of taxpayers and authorised goods

- Procurement and validation of digital tax stamps

Integration with existing customs and tax management systems

DATA SERVICES

- Accurate reporting of domestic production, imports and exports

- Monitor operational key performance indicators

- Analyse alerts and detect fraud patterns

The ultimate revenue

mobilisation solution

designed for tax authorities