SICPA RDC

Offices DRC, Kinshasa

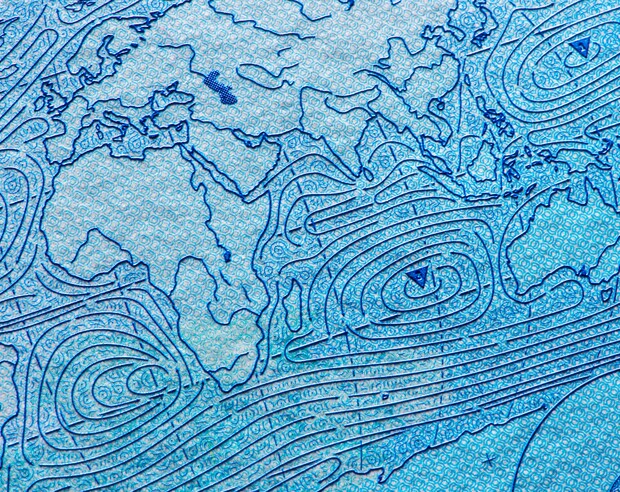

SICPA DRC was established to assist the Directorate General of Customs and Excise in implementing the country's excise duty traceability system. This initiative is designed to protect consumers, create fair business practices, and enhance revenue collection. SICPA also safeguards the Congolese franc as part of its expertise in Sovereign Monetary Systems.

News

Focus on

DGDA and SICPA DRC launch new campaign for consumer safety

In 2025, the Directorate General of Customs and Excise (DGDA), in partnership with SICPA DRC, launched a new campaign promoting the DGDA Connect App. This innovative tool empowers consumers to verify the authenticity and safety of the products they purchase, helping to protect health and build trust in the marketplace. By simply scanning, users can ensure their goods meet regulatory standards.

International institutions credentials

The International Monetary Fund (IMF) lauds SICPA DRC’s secure digital tax stamps system for its positive impact on revenue collection increase:

- “We are already observing results from the implementation of the Excise Duty Traceability System (STDA) on tobacco, telecommunications, and, more recently, on beverages.”

🔗Read more (IMF Report - 2024)

Sustainability

Empowering Sustainable Progress in DRC

SICPA DRC, aligned with SICPA Group commitment, acts as a responsible corporate citizen across the environmental, social, economic and governance spectrums.

SICPA DRC seeks to continuously enhance its environmental and social performance across its entire value chain, in alignment with the United Nations Sustainable Development Goals while contributing to SICPA Group’s decarbonisation efforts aiming at achieving carbon neutrality by 2035 and reaching net zero by 2050.

In addition, SICPA’s cutting-edge technology and solutions support our customers and society towards a more sustainable world by ensuring that sustainability efforts are not just aspirational but enforceable, data-driven, and resilient.

SICPA DRC