World Anti-Counterfeiting Day: Focus on Revenue Mobilisation & Conformity

On 10 June, SICPA announced the launch of a year-long series of articles to mark the World Anti-Counterfeiting Day.

Through these articles, we aim to raise awareness of the impact of counterfeiting and illicit trade on global trade, public safety and the economy. We will also showcase - How SICPA contributes to fostering legitimate trade, protecting citizens and supporting businesses.

The first article, published in June, explored the critical role of Brand Protection in tackling counterfeit goods, which each year cost the global economy up to €𝟮 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻.

Our second article below focuses on Revenue Mobilisation and Conformity, showcasing innovative solutions and success stories.

Upcoming articles:

December 2025: Focus on Fuel Integrity

March 2026: Focus on Digital Sovereignty

10 June 2026: Focus on Security Inks

Revenue Protection Meets Public Health: SICPA’ Strategic Role to Help Nations Fight Illicit Trade

Every year worldwide, billions of counterfeit and substandard goods make their way to consumers without passing through licit trade channels, exposing all of us to products that could potentially have a harmful effect on our health & safety as well as the environment. Simultaneously, there is a significant impact on legitimate businesses and manufacturers, as well as on governments, who lose tax revenue that could have been invested in social services, infrastructure, schools, or public health programs.

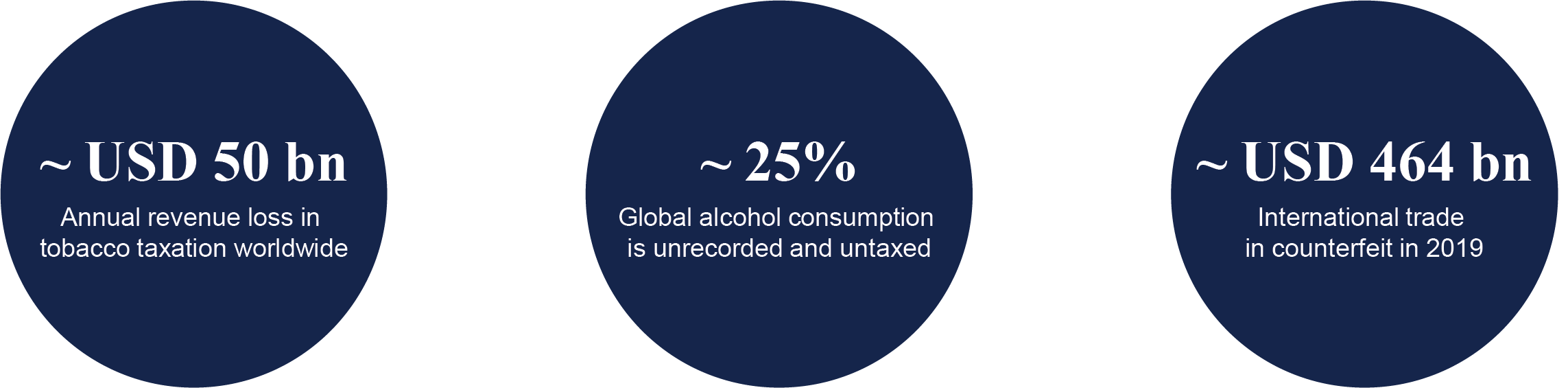

*See data source

Governments can counteract illicit trade by introducing technologies that facilitate the identification of genuine products in the market and by making it very challenging to avoid following tax regulation. To allow government authorities to enforce tax compliance and in turn make it more difficult to introduce counterfeit or adulterated products into market, it is essential to have a modern tax system in place with robust physical and digital technologies, backed by data-driven decision making. Implementing a modern tax system such as described permits government authorities to increase revenue streams, enhance enforcement policies and business compliance prevent unsafe consumption patterns and protect public health. Additional revenue becomes available to the authorities, which could be invested into other sectors that benefit society.

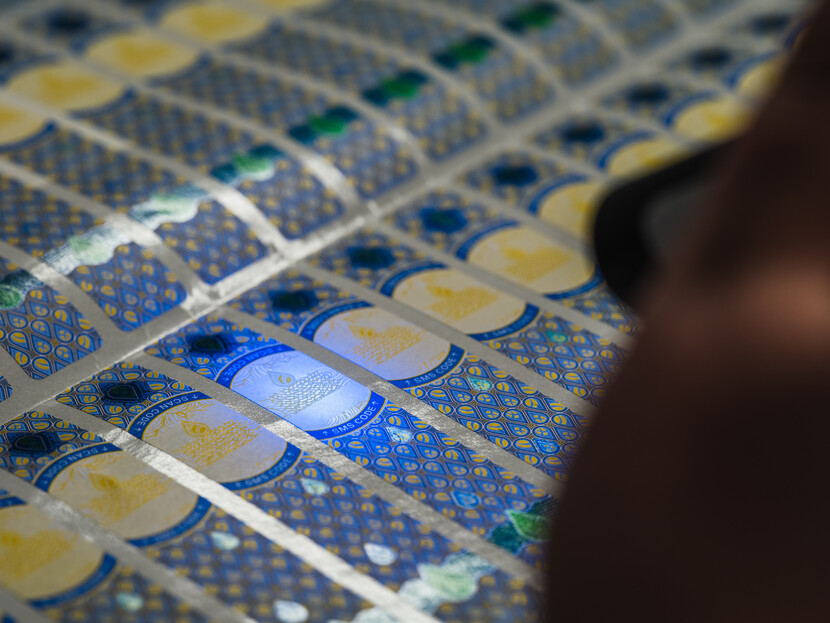

Empowering Nations with Secure Tax Stamp Technology

SICPA has been at the forefront of collaborative efforts to support several nations combat illicit trade. Our company’s secure digital tax stamps system brings proven, technology-driven capabilities to protect consumers, boost government revenues, and restore trust in the consumer goods market. Every year, more than 100 billion products are marked by our revenue mobilisation & conformity solutions worldwide.

SICPA’s secure tax stamp and product authentication system provides:

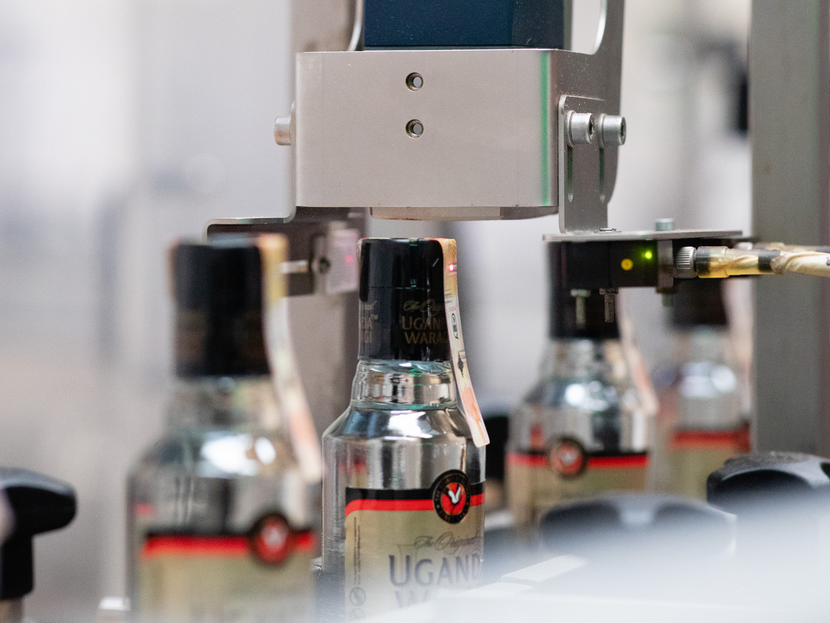

Tracking excisable products from production to point-of-sale, ensuring only compliant products reach the market.

SICPA’s secure digital tax stamps combine advanced physical and digital security features. This ensures that the data stored in databases remains reliable and can be verified against banknote-grade physical security features unlike purely digital solutions, which are often promoted by those seeking to profit from weaker controls.

Revenue authorities gain actionable intelligence on distribution patterns, illicit hotspots, and non-compliance. They can enhance the targeting of enforcement operations and optimise the efficiency of existing staff.

The technology provides court-admissible scientific evidence to convict fraudsters, thanks to the tax stamps’ material and digital features. Recently, SICPA’s testing lab earned ISO/IEC 17025 accreditation, a standard recognising the competence of laboratories in testing and calibration, like police forensic units.

Through SICPA consumer mobile app, consumers can authenticate products before purchase, reducing exposure to counterfeits and dangerous illicit items.

SICPA collaborates with fiscal authorities to conduct specific enforcement officers’ training, relating to the stamps and tools used to authenticate products and distinguish them from fakes or illicit products.

AI-Powered Solutions to Curb Illicit Trade in Tanzania

In Tanzania, the fiscal authority Tanzania Revenue Authority (TRA) has significantly curbed the issue of counterfeit and illicit goods through the integration of SICPA’s AI capabilities. Since its implementation in the country in November 2023, Digital Market Intelligence has enabled real-time tracking and detection of potential duplicated stamp codes, enhancing TRA’s ability to respond swiftly and accurately, and plan its enforcement staff accordingly.

This technological shift has led to billions of shillings in savings and a fourfold increase in inspection volume and anti-illicit trade practices. Public awareness campaigns and the consumer app (Hakiki App) have further supported the initiative, boosted manufacturer registration and increased declared production volumes.

More information in an article by the Daily News and Tax Stamp & Traceability News

International Acclaim for Nations’ Sovereignty Protection

Through its robust tax stamps systems, SICPA contributes to safeguarding nations’ wealth as well as to protecting their sovereignty. SICPA’ secure digital tax stamps are regularly cited by renowned international institutions such as the International Monetary Fund, the World Health Organisation or the World Bank for their ability to maximise nations’ tax revenue collection, participate in the fight against illicit trade and protect citizens against harmful products.

Quotes

"The January 2023 IMF country report highlights Uganda's projected tax revenue increase following the implementation of the digital tax stamps, amounting to UGX + 293 billion in 2022/23 and UGX + 222 billion in 2023/24."

International Monetary Fund

"In response to the declining revenue from excises in 2013, Kenya Revenue Authority (KRA) moved to a new system to strengthen the enforcement of excise duties on all excisable products. Key to the system was the rollout of EGMS"

International Monetary Fund

"KRA’s tax stamps system (EGMS) enabled KRA to seize more than 300 000 illegal products from about 900 outlets and prosecute more than 150 offenders in 2014, one year after its implementation in the country."

World Health Organization

*Data source

- According to the World Bank, the annual revenue loss in tobacco taxation worldwide is estimated at USD 40–50 billion, or 10% of global consumption.

The World Health Organization (WHO) estimates that nearly 25% of all alcoholic beverages consumed in the world are unrecorded (meaning not taxed and outside the usual system of governmental control, such as home or informally produced alcohol).

The Organisation for Economic Co-operation and Development (OECD) measured that in 2019, the volume of international trade in counterfeit and pirated products amounted to as much as USD 464 billion, or 2.5% of world trade, a significant part in volumes being fast moving consumer goods.